Saturday, February 26, 2022

War? What War?

Wednesday, February 23, 2022

Geopolitical Strife Continues to Push Stocks Lower

The Dow Jones Industrial Average declined 465 points (1.4%) to 33,132, the S&P 500 Index lost 79 points (1.8%) to 4,226, and the Nasdaq Composite plunged 344 points (2.6%) to 13,037. In heavy volume, 5.0 billion shares of NYSE-listed stocks were traded, and 4.8 billion shares changed hands on the Nasdaq. WTI crude oil nudged $0.19 higher to $92.10 per barrel. Elsewhere, the gold spot price advanced $3.00 to $1,910.40 per ounce, and the Dollar Index—a comparison of the U.S. dollar to six major world currencies—was up 0.2% at 96.22.

Friday, February 18, 2022

Leading Indicators snap positive streak, existing home sales surprisingly jump

The Conference Board's Leading Economic Index (LEI) for January declined 0.3% month-over-month (m/m), compared to the Bloomberg consensus estimate calling for a 0.2% gain, and following December's negatively-revised 0.7% increase. The LEI was negative m/m for the first time since February 2021, due largely to the negative net contributions from jobless claims, consumer expectations, stock prices, and average workweek, which more than offset positive reads for the interest rate spread and ISM new orders.

Existing home sales jumped unexpectedly by 6.7% m/m in January to an annual rate of 6.5 million units, versus expectations of 6.1 million units, which would have matched December's downwardly-revised rate. Existing home sales were higher in each of the major U.S. regions, while y/y sales were mixed as the Northeast and West saw declines, the South saw a modest increase, and the Midwest was flat. Sales of single-family homes jumped m/m but were down y/y, while purchases of condominiums and co-ops also rose m/m and declined from the prior year. The median existing home price was up 15.4% from a year ago to $350,300, marking the 119th straight month of y/y gains as prices rose in each region. Unsold inventory was at a 1.6-months pace at the current sales rate, down from the from the 1.9-months pace a year earlier. Existing home sales account for a large majority of the home sales market and reflect contract closings instead of signings so this report may not reflect the recent jump in interest rates.

National Association of Realtors Chief Economist Lawrence Yun said, "Buyers were likely anticipating further rate increases and locking-in at the low rates, and investors added to overall demand with all-cash offers …. Consequently, housing prices continue to move solidly higher."

Treasuries are mostly higher as choppiness remains, with the yield on the 2-year note little changed at 1.47%, while the yield on the 10-year note is declining 4 basis points (bps) to 1.93%, and the 30-year bond rate is decreasing 6 bps to 2.25%.

Treasury yields have moved higher as of late, with rates on the short-end of the curve decisively outpacing the moves on the mid-to-longer end, resulting in a dramatic narrowing of the spread between the 2-year note yield and the rate on the benchmark 10-year note. Expectations have been solidified by the Fed that it will tighten monetary policy aggressively through multiple rates hikes beginning in March. However, the markets have been volatile as they contemplate what the implications could be as uncertainty festers regarding whether the Central Bank will go against its historical norm of 25 bp hikes and opt for a 50 bp increase at some point. Moreover, the Fed has said it would also accompany this year's rate increases with efforts to shrink its more than $8 trillion balance sheet.

Tuesday, February 15, 2022

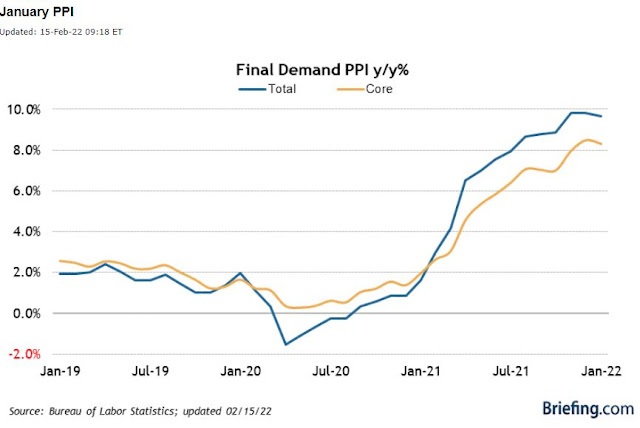

Wholesale prices rise further, adding to inflation fears

The Labor Department said Tuesday that its producer price index — which measures inflation before it reaches consumers, or wholesale prices — jumped 1% from December. Excluding volatile food and energy prices, wholesale inflation rose 0.8% from December and 8.3% from January 2021.

The Empire Manufacturing Index, a measure of activity in the New York region, showed the index moved back to a reading depicting expansion (a reading above zero) after surprisingly falling below the demarcation point last month. The index increased to 3.1 in February from -0.7 that was posted in January and compared to the Bloomberg estimate of an increase to 12.0.

Treasuries are mixed, as the yield on the 2-year note is 2 basis points (bps) lower to 1.57%, while the yield on the 10-year note is 4 bps higher to 2.03%, and the 30-year bond is increasing 3 bps to 2.33%.

As Q4 earnings season is set to roll on this week, of the 370 companies that have reported results in the S&P 500, 69.1% have topped revenue forecasts, while 76.4% have bested earnings expectations, per data compiled by Bloomberg. Compared to last year, revenue growth is on pace to be up nearly 16.3% and earnings expansion is on track for about 27.0%.

Thursday, February 10, 2022

Inflation Remains High, Jobless Claims Down, Earnings Update

The Consumer Price Index (CPI) rose 0.6% month-over-month (m/m) in January, above the Bloomberg consensus estimate of a 0.4% increase, and following December's upwardly-revised 0.6% gain. The core rate, which strips out food and energy, also increased 0.6% m/m, topping forecasts of a 0.5% gain, and matching December's unadjusted rise. Compared to last year, prices were 7.5% higher for the headline rate—the fastest pace since 1982—above estimates of a 7.3% increase and an acceleration from the prior month's 7.0% rise. The core rate was up 6.0% y/y, above projections of a 5.9% increase, and following December's unrevised 5.5% rise.

Weekly initial jobless claims came in at a level of 223,000 for the week ended February 5, versus estimates calling for 230,000, and down from the prior week's upwardly-revised 239,000 level. The four-week moving average declined by 2,000 to 253,250, and continuing claims for the week ended January 29 was unchanged at 1,621,000, versus of estimates of 1,615,000. The four-week moving average of continuing claims rose by 16,500 to 1,634,500.

Treasuries are falling following the inflation data, with the yield on the 2-year note jumping 12 basis points (bps) to 1.46%, while the yields on the 10-year note and the 30-year bond are rising 5 bps to 1.98% and 2.28%, respectively.

Earnings continue to support market values

In the end, earnings drive market values. As Q4 earnings season continues to roll on, of the 342 companies that have reported results in the S&P 500, 68.82% have topped revenue forecasts, while 76.54% have bested earnings expectations, per data compiled by Bloomberg. Compared to last year, revenue growth is on pace to be up nearly 16.36% and earnings expansion is on track for about 26.87%.

Tuesday, February 8, 2022

The Nasdaq Begins Trading

In 1992, Nasdaq joined with the London Stock Exchange to form the first intercontinental link between financial markets. Six years later, the Nasdaq exchange was the first in the world to create its own website and begin trading securities online. This cutting-edge model has historically attracted high-tech, growth-oriented companies, including Apple, Amazon, Tesla, and Microsoft, resulting in a volatile but often high-return market. More at History Quiz |

Monday, February 7, 2022

Friday, February 4, 2022

Study Finds Enhanced Jobless Benefits Prolong Unemployment

By Patrick Tyrrell & Anthony Kim

If common sense and reports from thousands of employers weren’t enough, a recent National Bureau of Economic Research paper found conclusively that paying people not to work during the COVID-19 pandemic was why many of them remained unemployed.

That shouldn’t come as a surprise to anyone, except that last year, major news reports were saying the opposite was true, before the evidence was in. Leave it to the American media to get something important wrong.

By comparing states that discontinued the overly generous unemployment benefit programs early against those who retained the payouts for the life of the program, the National Bureau of Economic Research researchers showed:

[I]n states that eliminated [the two pandemic-related expanded unemployment benefits programs] in June 2021, the share of 25-to-54-year-old unemployed workers who found employment rose by about 14.4 percentage points in July and August 2021 relative to the share in states that maintained both programs.

This effect is about two-thirds of the baseline monthly flow of unemployed prime-age workers into employment from February through June 2021 in the early-exit states.

Back in August of last year, The New York Times and other members of the media got it wrong. A New York Times front-page article’s headline and lead-in reported:

Cutoff of Jobless Benefits Is Found to Get Few Back to Work

Prematurely ending federal programs had little effect on employment but sharply cut spending, potentially hurting state economies, researchers say.

That would have been counterintuitive, and the National Bureau of Economic Research economists’ research disproves it. Also discrediting it, analysis by University of Chicago economist Casey Mulligan found that the states that did not end unemployment insurance benefits early would have gained 850,000 more jobs in July and August if they had experienced the same recovery paths as the states that did.

Instead, a basic law of economics holds true; namely, that if you pay people more for something, you get more of it, and unemployment is not an exception. Many people collecting enhanced unemployment benefits were being paid more than they had been for holding a job.A big problem with that is that no one aspires to collect unemployment benefits, because there’s no opportunity for advancing in life by taking a government check with the condition that you stay unemployed.

Another big problem: Unemployed people do not produce anything. They don’t make the economy grow, and America’s astronomical government debt load at 125% of gross domestic product in 2020 is a debt that future generations of Americans will have to pay back or make ever higher interest payments on, subject to the whims of whatever determines the rates.

Already, under current projections and absent a fiscal crisis, the Congressional Budget Office estimates that children today will face a $1.3 trillion annual cost (in today’s dollars) of interest on the debt two decades from now, when they are working.

That’s $8,600 per worker per year just on interest.

Unfortunately, deficit spending—which was 15% of GDP in 2020—is what has funded the prolonged enhanced unemployment benefits.

Moreover, an analysis by The Heritage Foundation found that 40% or more of the entire $873 billion in unemployment insurance benefits may have gone to criminals instead of the unemployed. (The Daily Signal is the news outlet of The Heritage Foundation.)

The Heritage Foundation has published the Index of Economic Freedom for 27 years. People paid to not enter the workforce are surrendering their labor freedom, which is one of the 12 components of economic freedom in the index.

Similarly, little children being saddled with government debt they will owe for the rest of their lives are having their economic freedom taken away from them to pay today’s adults to not work; as a result, both generations are less economically free.

Legislators should always ask when a policy proposal crosses their desk: “Does this policy proposal increase or decrease the economic freedom of the Americans who voted for me?”

The state governments that ended the gravy train of enhanced unemployment benefits early in their states made the right decision and gained economic freedom and greater opportunity for their constituents.

Top Five Consumer Cyber Security FAQs

By Equifax Business, technology, environmental and economic changes are a part of life, and they are coming faster all the time. All of thes...

-

After reading (and attempting the solutions offered in some) several articles about SQL and CAGR, I have reached the conclusion that none o...

-

By Equifax Business, technology, environmental and economic changes are a part of life, and they are coming faster all the time. All of thes...

-

The Texas Senate on Thursday approved a $500 million school choice bill mostly along party lines after hours of passionate debate. It will n...