Monday, December 5, 2022

Employment Picture Not As Rosy as Commonly Reported

This pattern held again for the November jobs report released Friday. Employment was up in the establishment survey by 263k, but the household survey dropped 138k. The divergence since March now stands at an enormous 2.7 million jobs.One reason is double counting in the establishment survey, with over 900k of the jobs added in the last year being workers with second jobs, not additional people employed.

To be sure, it is still a hot employment market for workers with some 10 million job openings. Count us as skeptical that this rosy jobs market will continue much longer.

The economy is hemorrhaging full-time jobs – we’ve lost over 2,600 full-time jobs every day since May.

Wednesday, November 30, 2022

National Debt at $31 Trillion: Does Anyone Care?

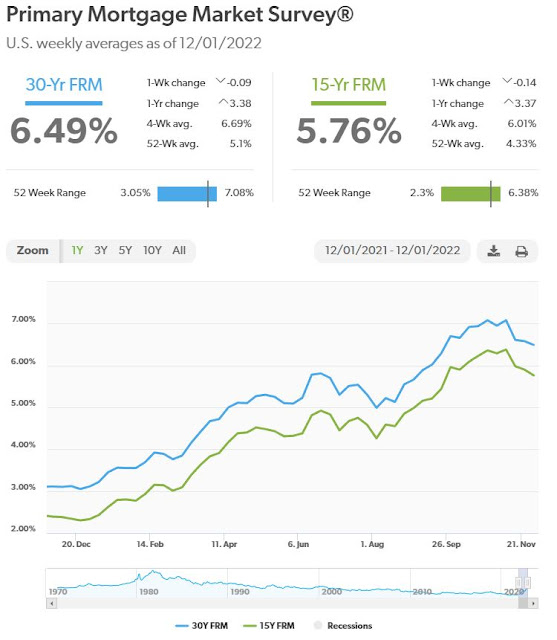

The budget deficit for FY2022 fell sharply because federal spending to fight the COVID-19 pandemic declined significantly, but it was still a large deficit. The budget shortfall declined to $1.375 trillion, compared to the 2021 deficit of $2.776 trillion.

President Biden has been trying to take credit for the huge decline in the budget deficit, but in fact his policies prevented the budget deficit from falling even further. America's growing national debt is the result of simple math — each year, there is a mismatch between spending and revenues. When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. And each year’s deficit adds to our growing national debt.

Historically, our largest budget deficits were caused by increased spending around national emergencies like major wars or the Great Depression.

Today, our deficits are caused mainly by predictable structural factors: our aging baby-boom generation, rising healthcare costs and a tax system that does not bring in enough money to pay for what the government has promised its citizens.

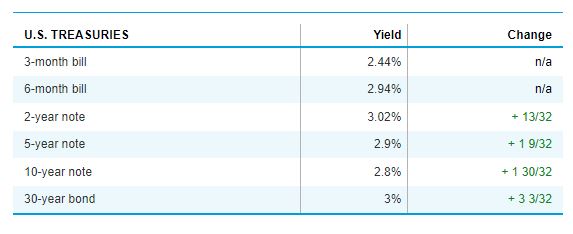

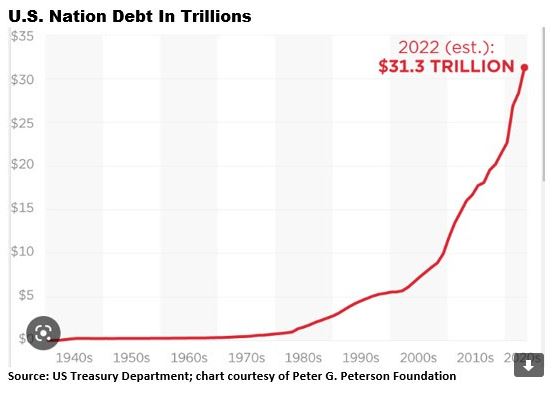

Inverted Yield Curve: Largest Gap Since 1981

The yield on the 10-year Treasury note dropped to 0.78 percentage points below the two-year yield, the largest negative gap since 1981, before easing slightly. The inversion reflects both surprising positive news on inflation as well as the view that the Federal Reserve will continue to raise interest rates and keep them at elevated levels.

Monday, November 28, 2022

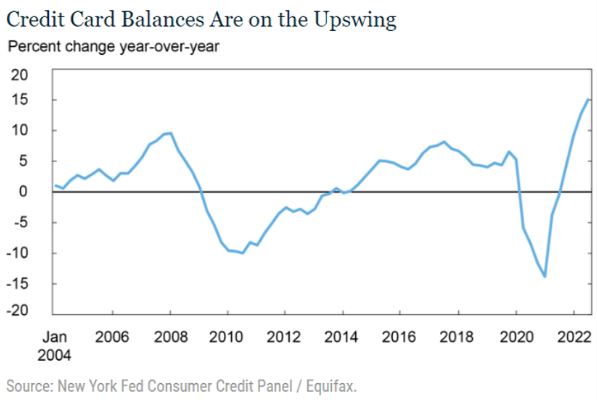

Credit Card Debt is on the Rise

Total household debt balances continued their upward climb in the third quarter of 2022 with an increase of $351 billion, the largest nominal quarterly increase since 2007. This rise was driven by a $282 billion increase in mortgage balances, according to the latest Quarterly Report on Household Debt & Credit from the New York Fed’s Center for Microeconomic Data. Mortgages, historically the largest form of household debt, now comprise 71 percent of outstanding household debt balances, up from 69 percent in the fourth quarter of 2019.

Read full article here.

Friday, November 25, 2022

What Behavioral Finance Can Teach Us About Investing

In 1979, they proposed the idea of prospect theory, which argues that people make decisions based on the potential value of gains and losses rather than the utility of a decision itself. Their empirical findings challenged the assumption that human rationality prevailed in modern economic theory – and in 2002, Kahneman even won the Nobel Memorial Prize in Economic Sciences. (See, we were right, they are super smart.)

To put it simply: investors are humans. We feel greed, fear, hope, excitement – all sorts of emotions impact our behavior on the micro and macro levels. It is precisely because we are human that we often make irrational decisions.

Behavioral finance is what happens when emotions, self-awareness and investing come together. It can help us understand these cognitive biases, as well as strategies for managing them. Here are four of those biases investors may feel:

- Overconfidence bias: The tendency to see ourselves as more knowledgeable than we actually are. This is common in investing. Overconfidence leads to rash and irrational behavior – like trying to time the market (or eating a really spicy pepper), even though markets are categorically unpredictable, and this has consistently proven to be a losing strategy in the long term.

- Herd behavior bias: When investors follow others rather than make their own decisions based on financial data (e.g. the Dutch tulip market, or stockpiling a meme stock because all your friends are doing it). People follow herds because it feels safer, or because of the FOMO (fear of missing out) they get from being on the sidelines.

- Anchoring bias: When an arbitrary benchmark – such as a stock’s purchase price – anchor’s one's decision-making process (“I won’t sell at $X because I bought at $Y!”). With anchoring bias, people tend to hold investments that have lost value because they’re anchoring its value to the price they bought it at, not market fundamentals.

- Loss aversion: When making decisions, people are more sensitive to losses than they are to gains. Robert Johnson, a professor of finance at Creighton University, argues that loss aversion can cost us money. "The biggest financial mistake people make is taking too little risk, not too much risk," he says. Loss aversion helps explain why: Losses hurt more than gains are enjoyed.

Since DCA is a fixed investment strategy, it neutralizes market performance as a decision factor. This can help you breathe easy instead of constantly making decisions based on anxiety, hunches or best-guesses. Sure, sometimes you might buy a little high. Other times a little low (party time!). But consistency is exactly what diversifies your purchase price – leveling out both losses and your anxiety. For this reason, DCA is an incredibly useful psychological tool for putting investments on auto-pilot.

Often finance and investing is thought of as a pure “numbers play,” but we humans just can’t do anything without putting our heart into things. So understanding why you make decisions, and how to rethink them when necessary, is one of the most important money skills you can learn.

Wednesday, November 23, 2022

Tuesday, November 22, 2022

Climate: Just Who Owes Who?

This all about money. Hundreds of billions of dollars of government handouts.

The one resolution of agreement among the politicians from 100 nations at the “Cop 27” climate conference in Egypt was that rich nations owe poor nations “climate reparations.” This is the looney concept that America is responsible for the supposed man-made warming of the planet by burning fossil fuels over the last hundred or so years. Joe Biden and his goof ball sidekick John Kerry were all to eager to buy into this “blame America first” narrative and write a 10-figure check to atone for our sins.

The conference in Egypt erupted into wild applause in the final hours when the multi-billion wealth transfer from American taxpayers to corrupt foreign governments like Venezuela was announced.

Wait!!! Biden thinks WE owe the rest of the world money for burning fossil fuels? Really? What have poor nations ever done for us? These supposed satanic fossil fuels have been the power source that liberated the world from human misery. They turned the lights on. They powered our factories, our transportation system, our technology industry, our homes, our hospitals our schools. This was a crime against humanity?

Fossil fuels made America rich and made the U.S. the bread-basket of the world helping end hunger and famine while developing drugs and vaccines that eradicated deadly diseases across the planet. They were the fuels used to help America win three world wars (counting the Cold War) on foreign soil against murderous fascist/communist regimes. To paraphrase Jack Nicholson in A Few Good Men: “A simple THANK YOU [from the rest of the world] would suffice.”

Over the last fifty years the United States has donated more than half a trillion dollars (more than the rest of the world combined) for disaster and foreign aid to seemingly every area of the rest of the world. Who owes whom money?

Oh, and was it mentioned that China and India skipped out of the conference this year. These are by far the two largest polluting nations (see chart). And they want no part of this war on fossil fuels. A climate change deal without China and India signing on would be like a peace agreement during the middle of World War 2 - except the bad news is that Germany and Japan aren’t on board.

Inflation is a Monetary issue

Two recent articles I've come across explain the phenomenon of inflation very well. Or pick up a book if you want more depth. Money Mischief would be a place to start.

Milton Friedman’s priceless lessons on inflation

Inflation – it’s on everyone’s mind. Everyone is talking about how inflation is the highest it has been in forty years. With the slowing economy, what was said to be a “transitory” phase has turned into “stagflation.”Some are blaming the government. The government is blaming the war. Republicans are blaming the Democrats, and the left is blaming greedy corporations. As the blame game and alarm rage, it remains a fact that most of us don’t know what inflation is. Few know what causes it. Fewer know how it can be curbed.

Under the circumstances, it pays to listen to the respected American economist Milton Friedman as he deconstructs this “alarming” phenomenon. The Nobel Laureate, speaking at the University of San Diego and the San Diego Chamber of Commerce in 1978, busted some well-established myths and shed light on the causes and cures.

Central Bankers Dodging Blame

The great Milton Friedman repeatedly explained that rising prices are an inevitable consequence of easy-money policies by central banks.That’s a lesson everyone should have learned about 50 years ago when the Federal Reserve unleashed the inflation in the 1960s and 1970s (also blame Lyndon Johnson and Richard Nixon for appointing the wrong people).

Friday, November 11, 2022

Stock and Bonds Down for Year, Even with Recent Rally

I guess my portfolio (13% Bond, 70% Stock and 17% Cash) isn't doing to badly, with a YTD return (including dividends) of 3%. About 25% of my stocks are either in, or were, in energy. I sold about half my holdings a few months ago and invested in income producing ETFs.

Thursday, November 10, 2022

Inflation Eases to 7.7%. But Still High

Friday, October 28, 2022

The Push Toward Socialization

Just when you thought it couldn't get any worse. Democrats are now pushing two very bad ideas: 1) Do away with the "gig" economy, as California has done with its draconian restrictions on independent contractors; and 2) nationalize the oil and gas industry.

The attack on American's right to work

The Biden administration has effectively declared war on gig work, with its Department of Labor proposing a new federal regulation inspired by California’s controversial AB 5 law that would limit people’s ability to be classified as independent contractors and work as they choose.

More on GIG ECONOMY

The End of Freelancing?

AB 5, which essentially bans independent contract and freelance work, was one of the most hated bills to emerge from the Sacramento sausage-making process in recent memory.

Using the aforementioned “ABC test” developed by the California Supreme Court, the law establishes who can legally work on a contractual basis and who must be a hired employee. The classification bar set by the test is so high that few freelancers can clear it. Consequently, almost every independent contractor has to become a hired employee, form their own business, or lose their job.

This is no accident: The aim of AB 5 was to force employers to put their gig workers on the payroll, along with all the costs — unaffordable for many businesses and organizations — that are associated with doing so.

In his public statements about the newly proposed regulation, Secretary of Labor Marty Walsh has resorted to the same duplicity that California lawmakers used first in passing, and then in defending, the indefensible AB5. In a recent press release, for example, Walsh said the rule is needed to safeguard “our nation’s most vulnerable workers,” ensuring that they are not deprived of “their federal labor protections.”

How to make the energy market collapse

In response, influential Democrats, including a leading U.S. Senate candidate, a former Department of Energy official, and an influential energy expert, are urging the U.S. government to socialize America’s oil and gas firms.

At a Houston conference last week, Jason Bordoff, Dean of Columbia University’s Climate School, called for the “nationalization” of oil and gas companies. “Government must take an active role in owning assets that will become stranded,” he said, “and plan to strand those assets.” By “strand” Bordoff meant “make financially worthless.” Bordoff made the point at least twice during the confrerence. Bordoff’s call shocked many in the audience. “Jason is smart, well-informed, and well-connected to the Biden Administration,” said someone who was at the conference, “so these comments are scary.”

The calls come on the heels of two other Democrat-led efforts to expand U.S. government control over oil and gas production. One is a piece of legislation called “NOPEC,” which passed the Senate Judiciary Committee in May. The bill would change U.S. antitrust law to revoke a policy of sovereign immunity, which protects OPEC+ members from lawsuits. If NOPEC became law, the U.S. attorney general could sue Saudi Arabia and other OPEC members in court. The result could be a disruption of global supplies of oil and other commodities if nations retaliated against the U.S.

The other is an effort led by Treasury Secretary Janet Yellen to cap the price of Russian oil sold on global markets, which I and many other experts have warned since June is unworkable, because China and India have said they would circumvent it, and could backfire, resulting in far higher oil prices. Last week, analysts with Rapidan Energy told the same Houston conference that the December 5 implementation of the Russian price cap could reduce global supplies of oil by 1.5 million barrels per day. Such an amount would create an oil price shock.

Earlier this month, Bordoff told the World Economic Forum, which has called for a “Great Reset” to quickly move from fossil fuels to renewables, that climate change required a “massive transition” that is “going to be messy, it’s going to be disruptive.” Said Bordoff, “I think part of the broader macro environment that's happening now is one of more disruptive change because of climate impacts, but also more disruptive change because of geopolitics coming out of the pandemic, coming out of this conflict, completely rethinking what the World Economic Forum is all about.”

Friday, October 21, 2022

We live in a society full of insufferable narcissists

Reposted from the Washington Examiner

I have written extensively over the past year about the victims of gender ideology: the children and young adults struggling with the normal pangs of maturation who get swept away by a movement that promises them identity and community, and the parents who feel helpless as they desperately try to drag them back to reality.

But let’s be clear about something: Not everyone in this movement is a victim. All you have to do is watch some of the videos highlighted by accounts like Libs of TikTok, and you’ll realize that many of these gender ideologues are unabashed activists who would love nothing more than to shove their crazed distortion of reality down your throat. They know that what they are preaching is nonsensical, and they relish the idea of forcing you to conform to it.

Here’s a perfect example of this kind of narcissism, which runs rampant in leftist circles:

This is a young man who is so obsessed with himself and his new identity that he felt the need to create a video complaining about customers who fail to refer to him by his preferred “they/them” pronouns. Never mind his Adam’s apple and visible male proportions. He expects you to disavow what you’ve seen with your own eyes and submit to his version of reality, in which he’s not a male but a gender-fluid unicorn who has defied the heteronormative patriarchy to reach a new level of diversity and inclusion. As Jeb Bush would say, please clap.

There’s a comedic element to all of this in that it’s so obviously absurd that one wonders whether even the young man is able to take himself seriously. But the thing is, I’m past the point of finding any of this funny. I don’t laugh anymore when I read stories about corporate offices adding ridiculous pronoun options like “fae/faer” and “bun/bunself” to their email signatures, or about how college campuses are overrun with students who expect you to start a conversation by asking, “What are your pronouns?”

And that’s because I recognize videos like this one as the threat that it is. Gender ideologues like this young man don’t want respect or even basic courtesy. They want submission, and they’re determined to get it.

Activists have worked with Big Tech companies to censor and de-platform users who “misgender” people like Deputy Secretary of Health and Human Services Rachel Levine. Multiple teachers and professors who have refused to use students’ preferred pronouns have been punished and, in some cases, even fired. Two middle school students in Wisconsin were even subjected to a Title IX complaint for failing to use a peer’s preferred pronouns correctly. And in the United Kingdom, British police warned citizens that they could find themselves at the center of a criminal investigation for misgendering someone.

There is no such thing as the tolerant Left. How could there be, when the people who make up the movement are such insufferable narcissists?

Thursday, October 20, 2022

Economic Projections: Like the Weather Forecast

Why economic forecasts are unreliable. Or maybe it's the CBO. The Fed and most economist have not done very well, historically. This chart shows projections for inflation compared to actual inflation.

Thursday, August 18, 2022

Inflation Reduction Act: Will Never Reduce Inflation

Yet here is the statement that Maya McGuineas of CFRB put out to the press:

- This legislation focuses on lowering health care and energy costs, raising revenue, and reducing deficits and is exactly what the doctor ordered.

- Senator Manchin deserves tremendous credit for pushing this fiscally responsible reconciliation bill.

Sadly, the CFRB has a history of supporting multi-trillion dollar bailout bills and CFRB OPPOSED the Trump tax cut of 2017 – which ended up RAISING revenues and helped create the strongest American economy in decades.

CFRB has again exposed itself as "bipartisan." Bipartisan? They supported the most partisan bill in modern times: every Democrat voted for this bill and not a single Republican, CFRB is now officially a front group that gives aid and intellectual support to the tax and spend forces on Capitol Hill.

Wednesday, August 10, 2022

Prices Surge 8.5 Percent

The Consumer Price Index, a key measure of the cost of goods and services, dropped slightly due to a decline in record-high fuel prices which drove the previous month’s historic inflation spike. The increase also beat expectations as economists surveyed by Dow Jones expected headline CPI to increase 8.7 percent year-over-year in July.

Excluding volatile food and fuel prices, core inflation rose 5.9 percent annually and 0.3 percent monthly.

The average national fuel price stood at $4.010 per gallon as of Wednesday, down from a record-high $5.016 in mid-June.

Despite the slight relief offered by declining fuel prices, the Federal Reserve is still expected to further raise interest rates to bring inflation closer to its target of 2 percent.

Voters across the country consistently rank inflation as one of their top priorities going into November’s midterm elections. Republicans have consistently highlighted the Biden administration’s aggressive spending, arguing that the $1.9 trillion Covid-relief bill passed weeks after Biden took office overheated an already hot economic recovery.

While Biden has repeatedly denied that the package contributed to record inflation, even calling the idea “bizarre,” the moniker attached to the Democrats’ latest spending bill — The Inflation Reduction Act — at least nods toward voters’ concerns, though non-partisan analysts have said the legislation’s impact on inflation will be negligible.

The $433 spending bill, which passed the Senate over the weekend and is expected to be signed by Biden this week after passing the House, includes $369 billion for climate initiatives and another $80 billion to double the size of the IRS. It also imposes a 15 percent corporate tax on businesses worth more than $1 billion.

Markets reacted positively to the Wednesday CPI numbers, with Dow Jones up more than 500 points as of 8:50 a.m. CDT and government bonds down sharply.

Thursday, August 4, 2022

Inflation Reduction Act Will Not Reduce Inflation

Reconciling the reconciliation bill: The Inflation Reduction Act, successor to the House-passed Build Back Better Act of late 2021, has been touted by President Biden to, among other things, help reduce the country’s crippling inflation.

Among the major tax changes are a 15 percent corporate minimum tax, drug price controls, IRS tax enforcement, and a tax hike on carried interest to pay for increased spending on energy and health insurance subsidies as well as deficit reduction. See a more comprehensive list here.

According to our model, the bill would raise about $304 billion in net revenue from 2022 to 2031, but would do so in an economically inefficient manner, reducing long-run economic output by about 0.1 percent, eliminating about 30,000 full-time equivalent U.S. jobs, and reducing average after-tax incomes for taxpayers across every income group in the long run.

What about inflation? On balance, the long-run impact on inflation is uncertain but likely close to zero.By reducing long-run economic growth, the bill may worsen inflation by constraining the productive capacity of the economy.

By increasing spending faster than it raises revenue between 2023 and 2025, the bill would increase deficits and worsen inflation, especially in the first two years. See our full analysis.

Monday, August 1, 2022

New Legislation Will Raise Taxes on Everyone

Families earning less than $400,000, according to Joe Biden were not going to pay even “a dime of new taxes” under his tax plan.

This was Joe Biden’s signature promise. It was the 2020 campaign’s equivalent to George H W Bush’s “read my lips, no new taxes” pledge back in 1988.Anyone who believed Joe probably deserves to pay more taxes.

Anyway, here are the facts. Congress’s official budget and tax scorekeeper, the Joint Committee on Taxation, finds taxes rising in every income bracket. It’s a $17 billion a year whack at the lower and middle-class Americans.

Thursday, July 28, 2022

America's Horrific Long-Term Fiscal Forecast

Some people think America's main fiscal problem is the gap between the two lines. In other words, they worry about deficits and debt.

But the real problem is government spending. And that's true whether the spending burden is financed by taxes, borrowing, or printing money. Full story here.

GDP Got Eaten By Inflation

Why was real GDP negative in the first half of this year? Because inflation ate up all the gains.

The bombshell report this morning showed that real GDP shrank again in the second quarter, by 0.9% annualized, after a 1.6% drop in Q1. But wait, how can real GDP be shrinking while the labor market at the same time added 2.7 million jobs, and the unemployment rate fell from 4% to 3.6%? Because inflation ate up all the real economic gains.

Nominal GDP--actual dollars before any adjustment for inflation--surged by a whopping 6.6% in the first quarter, and 7.8% in the second quarter. That's twice the size of what we used to see in the sluggish expansion of the 2010s. Turns out, it's way more than this economy can actually handle. So the huge nominal GDP boom we've had is all simply going into higher prices; the inflation rate was over 8% in the quarter, and that's how you end up with a negative "real" print.

Was the U.S. actually in recession, meaning the end of a business cycle? Probably not, as we've already discussed. The economic indicators, from the labor market to retail sales to industrial production, were all higher in May than January, and so far for June as well. Just yesterday, new orders for durable goods--a key leading indicator--came in stronger than expected. Orders have steadily risen this year, running as of last month at a 6% annualized pace--which would not be happening at the end of a business cycle. As for leading gauges of the labor market, new jobless claims actually fell last week, to a modest 256,000.

What this all shows is an economy that was overheated by monetary and fiscal stimulus, not one that was too soft or too weak. How else do you end up with 8% surging nominal GDP last quarter, on top of last year's whopping 10% gain? Certainly you don't get that from supply-chain constraints or high oil prices. And because we couldn't handle it all quickly enough as "real" economic gains, instead we simply got higher prices.

Sunday, July 24, 2022

Fully Funding Education

In the race for Texas governor, Beto O'Rouke keeps claiming that he'll fully fund education. But it's already over-funded, and without the legislature, he can't do anything. Empty promises. Currently, more than $60 billion is spent on Texas education (not including universities).

Saturday, July 23, 2022

Yield Inversions Are Back; Get Very Little Mention In Press

Federal bond yields, when inverted, normally signify an upcoming recession. That's something we've been anticipating for some time, so whether it's a predictor or confirmation, is anyone's guess. It's not the first time yields have inverted in the last year or so.

It's just something all investors should be aware of, and plan for accordingly. I think the overall market has priced in these facts already, with the DJIA down about 15%, the SP500 down 18%, the NASDAQ100 down 25%, and the Russell down 27%.

These declines are up from yearly lows, with rebounds of 5% to 10% in the last month or so.

This chart shows the short term bonds have larger yields than the longer term 10-year and 30-year bonds. It should be the other way around.

Friday, July 22, 2022

It's Not Just Gas: Food Prices Skyrocket

Driving the increase: Energy prices were responsible for more than half of the monthly gains in headline inflation, with gas prices rising over 11% last month, Axios' Neil Irwin and Courtenay Brown write.

However, the average price of regular-grade gas is falling. As of this morning, it is at $3.92 in the greater Austin area — down from $4.65 a month ago.

Thursday, July 21, 2022

Inflation Costs $8,000 in Purchasing Power

- Prices increased 13.3 percent from January 2021 to June 2022, costing the average American household $718 last month alone

- Even if prices stop increasing altogether, the inflation that has already occurred will cost the average American household $8,616 over the next 12 months.

- In the United States overall, the monthly inflation cost in June 2022 was highest within transportation ($343), followed by energy ($214), food ($85), and shelter ($81).

- Families in Colorado are facing the highest transportation inflation ($487) and shelter inflation costs ($149); families in California are facing the highest food inflation costs ($111); and families in Texas are facing the highest energy inflation costs ($282).

Friday, July 15, 2022

Biden Sells Off Strategic Oil Reserve

Thursday, July 14, 2022

Housing Affordability Index Continues to Weaken

Wholesale Inflation Surges to 11.3 Percent

The Labor Department reported Thursday that the U.S. producer price index, or PPI — which measures inflation before it hits consumers — rose at the fastest pace since hitting a record 11.6% in March.

Last month’s jump in wholesale inflation was led by energy prices, which soared 54% from a year earlier. But even excluding food and energy prices, which can swing wildly from month to month, producer prices in June jumped 8.2% from June 2021. On a month-to-month basis, wholesale inflation rose a substantial 1.1% from May to June.

Thursday's PPI report came a day after the Labor Department reported that surging prices for gas, food and rent catapulted consumer inflation to a new four-decade peak in June, further pressuring households and likely sealing the case for another large interest rate hike by the Federal Reserve.

Consumer prices, as measured by the consumer price index, or CPI, soared 9.1% compared with a year earlier, the biggest yearly increase since 1981.

Wednesday, July 13, 2022

Inflation in at 9.1 percent. Nothing to see, says Biden

More than half of all Americans weren’t even alive the last time prices rose at this pace of 9.1%. Yet Democrats say dam the torpedoes and full speed ahead with another $1 trillion tax and spend bill. Stimulus is a large part of what caused this runaway inflation to begin with. I wonder why they don't get it.

Biden remarked that the data was backward looking, that June's numbers didn't reflect the drop in oil prices in July. Nothing to worry about. These aren't the droids you're looking for. OMG. All data is backward looking; otherwise, its a projection or prediction, or just a wild ass guess. Even the Carter administration didn't have this level of incompetence.

This is a scary bunch ruling Washington these days. November can’t get here soon enough.

Friday, July 8, 2022

Thursday, July 7, 2022

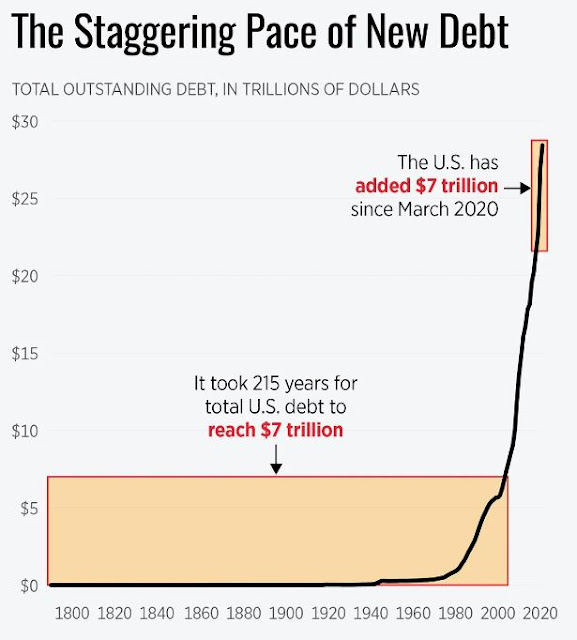

Pace of New Debt

To put that in perspective, the federal debt reached a total of $7 trillion in 2004, covering a span from George Washington to the first term of George W. Bush.

That means the federal government has racked up 215 years’ worth of debt in just 27 months.

While some amount of deficit spending might have been hard to avoid during the worst of the COVID-19 pandemic, Washington kept breaking out the credit card to continue an unnecessary and wasteful spending spree, oversaturating the economy and making inflation problems inevitable.

Tuesday, May 31, 2022

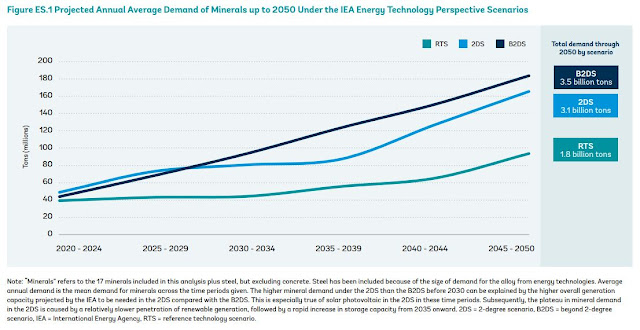

World Bank: Green Energy to be Disruptive to Mineral Markets

Recently, even some environmentalists are pointing to a the World Bank report showing that moving toward 100% solar, wind, and electric battery energy would be “just as destructive to the planet as fossil fuels.” This was the conclusion of a story in Foreign Policy magazine in 2019, The Limits of Clean Energy.

Here are the estimates, of how much minerals would be needed:

- 34 million metric tons of copper

- 40 million tons of lead

- 50 million tons of zinc

- 162 million tons of aluminum

- 4.8 billion tons of iron

Saturday, May 28, 2022

An emboldened Fed

Stocks rally: The market appeared to take the minutes as more dovish than hawkish. Half-point hikes were already priced in for the next couple of meetings and there was no mention of 75-basis-point moves that had become the base case for a few Wall Street banks at the end of April.

The S&P 500 (SPY) rose about 1% to finish out the session and S&P futures (SPX) are up again this morning. Treasury yields (SHY) (TBT) (TLT) continued to creep lower Friday.

Data dependence: "We think that after the July meeting the Fed is likely to become more 'data dependent' with regard to rate hikes, which essentially means that the policy path after July will depend upon the trajectory of inflation and progress toward correcting the supply/demand imbalances in the labor market," BlackRock fixed income strategist Bob Miller said.

There are already signs that the U.S. economy is weakening. Of the last 19 major economic indicators, 13 have missed economists' expectations, Nomura noted. The question is whether that will bring about a Fed pause, which stock bulls are hoping for, or will it stiffen the central bank's resolve.

If there are signs of falling inflation and improved labor market imbalances "the Fed gains some breathing room and can shift policy adjustments to 25 bps increments, while still pursuing something in the estimated range of neutral," Miller said.

Pantheon Macro economist Ian Shepherdson says the door is still open to a smaller hike in July given the minutes show policymakers "appear utterly oblivious ... to the rollover in housing demand, which has been evident in the mortgage applications data since the turn of the year." That will change in the June minutes, he added.

But Nomura strategist Charlie McElligott says those hoping for a Fed pause will likely be disappointed, noting Fed chief Powell's willingness to endure "some pain" in getting price stability.

"I think that if anything, the Fed is seeing the results of their (financial conditions index) tightening campaign through these broad measures 'slowing' and could actually become incrementally 'emboldened' to keep PUSHING on their hiking path until they see the 'whites of the eyes' of sustainably lower inflation as opposed to the notion of 'pausing and hoping' for the inflation data to move lower - a view that is increasing held by some in the market," he said.

Tuesday, May 24, 2022

Earth To Powell, Come In Chairman Powell

“The underlying strength of the U.S. economy is really good right now. The U.S. economy is strong, the labor market is extremely strong. It is still at very healthy levels. Retail sales numbers, the economy is strong. Consumer balance sheets are healthy. Businesses are healthy. The banks are well-capitalized. This is a strong economy.”

Now isn’t that reassuring? Never mind that the growth rate of this “strong economy” so far this year is less than one percent.

But he wasn’t done with his happy talk. When the Fed chief was asked about whether he is behind the curve on raising rates (which he clearly is), Powell had this to say:

"By the standards of central bank practices in recent years, we've moved about as fast as we have in several decades.”

This is a non sequitur because the reason the Fed hasn’t had big rate hikes “for several decades,” Jay, is because we haven’t had to combat eight percent inflation for three decades.

Powell’s lame steps to bring down inflation reminds us of a favorite old joke. What did the snail say when he climbed on the back of the tortoise?

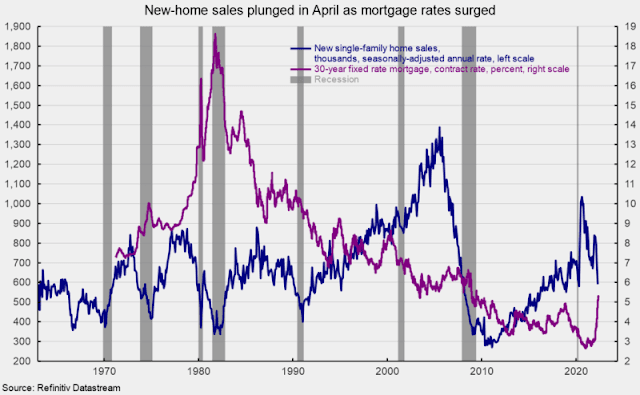

The Law of Supply and Demand: Housing Sales Fall

A normal supply and demand curve indicates that as prices increase, demand will moderate or decline, until the curve reaches a new equilibrium. That is what is happening this year in housing.

Sales of new single-family homes plunged in April, declining 16.6 percent to 591,000 at a seasonally-adjusted annual rate from a 709,000 pace in March and just slightly ahead of the 582,000 pace at the bottom of the lockdown recession.The median sales price of a new single-family home was $450,600, up from $435,000 in April (not seasonally adjusted). The gain from a year ago is 19.6 percent versus a 21.0 percent 12-month gain in April. On a 12-month average basis, the median single-family home price is still at a record high.

The total inventory of new single-family homes for sale jumped 8.3 percent to 444,000 in April, putting the months’ supply (inventory times 12 divided by the annual selling rate) at 9.0, up 30.4 percent from April and 91.5 percent above the year-ago level.

Monday, May 23, 2022

Beware The Impending Natural Gas Crisis

Another energy crisis may be brewing, and that is a result of the surge of natural gas prices. (Don’t forget, natural gas is by far the number one source for electric power generation in America.) Here at home, those prices have climbed from less than $3 per MMBtu in 2020 to $7.40 as of last week. (See chart.) This is close to a 150% increase in price.

James Grant from the Interest Rate Observer warns that the price may double or triple in the months ahead.

Aren’t you thrilled that Energy Secretary Jennifer Granholm is on the job to prevent this calamity from happening?

Saturday, May 21, 2022

Price controls again? Some people never learn

On Thursday, Pelosi pushed through the House her Consumer Fuel Price Gouging Prevention Act – which would allow the president to declare an “energy emergency proclamation” when prices are rising. During the emergency, companies would be barred from charging “unconscionably excessive” prices for gasoline or any other fuels. The Federal Trade Commission and state attorneys general would be empowered to pursue violators.

There is no legal definition of price gouging, but apparently, it is the new pornography – the pols know it when they see it.

Sadly, only four Democrats – Liz Fletcher of Texas, Jared Golden of Maine, Kathleen Rice of New York, and Stephanie Murphy of Florida – voted no.

Pelosi isn’t done yet. She is now pressuring the administration to file criminal charges against baby formula companies. “I think there might be a need for indictment,” Pelosi said when asked about her plans to combat the formula shortage. No one mentioned that even her own Appropriations Committee chair admits the baby formula shortage was primarily caused by the FDA’s months-long failure to investigate poor sanitary procedures at an Abbott plant in South Dakota.

These price control measures will make supply chain problems worse and cause prices to rise even faster.

|

| Speaker of the House insultingly tears up Trump's speech during his State of the Union. She is one of the most disgraceful and corrupt people to "serve" in the U.S. Congress. |

Thursday, May 12, 2022

US Producer Prices Surge 11 Percent on Higher Food Costs

The cost of groceries in the past 12 months is up 10.8%, the largest 12-month increase since November 1980, The Wall Street Journal reports, citing Labor Department consumer price index (CPI) data. Grocery costs rose 1% in April after increasing by 1.5% in March; they have risen by 1% or more in the past four months. Dairy prices, led by milk, shot up the most in April, by 2.5%.

The April year-over-year increase in the April PPI declined from the 11.5% annual gain in March, which was the biggest increase since records began in 2010.

The producer price data captures inflation at an earlier stage of production and can sometimes signal where consumer prices are headed. It also feeds into the Federal Reserve's preferred measure of inflation, the personal consumption expenditures price index.

Thursday's figures came just a day after the government released consumer price data for April, which showed that inflation leapt 8.3% last month from a year ago. That increase is down slightly from the four-decade high in March of 8.5%. On a monthly basis, inflation rose 0.3% in April from March, the smallest increase in eight months.

Still, there were plenty of signs in the consumer price report that inflation will remain stubbornly high, likely for the rest of this year and into 2023. Rents rose faster as many apartment buildings have lifted monthly payments for new tenants. Prices for airline tickets jumped by the most on records dating to 1963. And food prices continued to rise sharply.

Sources: AP and NewsMax

Wednesday, May 11, 2022

Inflation slows slightly, mortgage applications up

Though it wasn't much, markets responded positively.

Nationally, the price of a gallon of regular gas has reached a record $4.40, according to AAA, though that figure isn’t adjusted for inflation. The high price of oil is the main factor. A barrel of U.S. benchmark crude sold for around $104 early Wednesday morning. Gas had fallen to about $4.10 a gallon in April, after reaching $4.32 in March.

Beyond the financial strain for households, inflation is posing a serious political problem for President Joe Biden and congressional Democrats in the midterm election season, with Republicans arguing that Biden’s $1.9 trillion financial support package last March overheated the economy by flooding it with stimulus checks, enhanced unemployment aid and child tax credit payments.

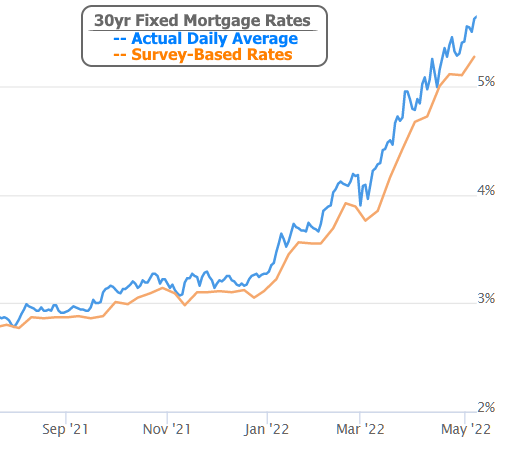

In other news, the MBA Mortgage Application Index rose 2.0% last week, following the prior week's increase of 2.5%. The second-straight weekly increase came as a 2.0% drop in the Refinance Index was more than offset by 4.5% gain in the Purchase Index. The average 30-year mortgage rate resumed its jump, rising 17 basis points (bps) to 5.53%, up 242 bps versus a year ago.

Monday, May 9, 2022

ICYMI: Recent Headlines

It was yet another tough week for the mortgage market with rates rising to their highest levels since 2009, but how high have they actually risen?

WTI crude futures (CL1:COM) jumped 4.9% for the week to $109.77/bbl, July Brent futures (CO1:COM) also added 4.9% to $112.39/bbl, and gasoline futures (UGA) in New York settled at a record high $3.76/gal, three weeks before the start of the U.S. summer driving season.

Losing the People? Then Change the Rules

Court-packing—the attempt to enlarge the size of the Supreme Court for short-term political purposes—used to be a dirty word in the history of American jurisprudence.

The Disinformation Governance Machine

Right out of 1984. Homeland Security Secretary Alejandro Mayorkas announced on April 27 the creation of the “Disinformation Governance Board.”

The Nation's Top Scientists Lied

Scott Atlas stated the simple fact that immunity is higher than those with antibodies, whereupon Dr. Fauci criticizes him without contradicting what was actually said. Stating a simple scientific fact is not ‘extraordinarily inappropriate.’ What is going on?

Interest rates are on the rise, but they’re still historically cheap. That’s partially because the federal funds rate — a key borrowing benchmark set by the Federal Reserve — has remained below its historic average for the past 16 years. In fact, the Fed’s key rate spent nine of those years at the rock-bottom level of 0 percent, first from 2008 through 2015, and then from March 2020 to March 2022.

President Joe Biden recently sent an emergency supplemental funding request to Congress for $33 billion in aid to Ukraine. However, the administration used the opportunity to sneak in unlawful immigration benefits for hundreds of thousands of Ukrainian, Afghan, and Russian immigrants—paid for by the American people and at the expense of lawful applicants who have been waiting years to properly immigrate to the U.S.

Wednesday, May 4, 2022

Is there a housing bubble?

Is there a housing bubble?

U.S. housing affordability fell last month to near the lowest level ever as home prices surge. Mortgage interest rates now exceed 5.2% – up from 3.6% two years ago. And the Fed is raising rates again – as it should – but this too will likely raise mortgage rates.

The average mortgage payment is now $1,800 a month. That’s 70% higher than the pre-Covid high. The only other time home payments were this high was in 2007 on the eve of the Great Financial Crisis.

As the chart below from Black Knight’s mortgage monitor shows, home prices are up 19.9% over this time a year ago. Yes, that’s very good news for homeowners as their home equity surges, but a killer for home buyers – especially first-time buyers.

Loan to income levels are also rising, which makes defaults more likely.

Is any of this sounding familiar? All of this has been artificially inflated by years of artificially low rates, Fed policies of purchasing hundreds of billions of dollars of mortgage-backed securities, and Congress passing out hundreds of billions for taxpayer funded rental assistance.

It’s all helium pumped into a balloon that could soon pop.

Sunday, May 1, 2022

The GDP contraction was due to inflation

Thursday, April 28, 2022

Economy shrinks for first time in two years

The Commerce Department's estimate Thursday of the first quarter's gross domestic product — the nation's total output of goods and services — fell far below the 6.9% annual growth in the fourth quarter of 2021. And for 2021 as a whole, the economy grew 5.7%, the highest calendar-year expansion since 1984.

The economy is facing pressures that have heightened worries about its fundamental health and raised concerns about a possible recession. Inflation is squeezing households as gas and food prices spike, borrowing costs mount and the global economy is rattled by Russia's invasion of Ukraine and China's COVID lockdowns.

While recession expectations on Wall Street remain low, there’s further trouble ahead for the economy: In an effort to combat burgeoning price increases, the Federal Reserve plans to enact a series of rate hikes aimed at slowing growth further.

Top Five Consumer Cyber Security FAQs

By Equifax Business, technology, environmental and economic changes are a part of life, and they are coming faster all the time. All of thes...

-

After reading (and attempting the solutions offered in some) several articles about SQL and CAGR, I have reached the conclusion that none o...

-

By Equifax Business, technology, environmental and economic changes are a part of life, and they are coming faster all the time. All of thes...

-

The Texas Senate on Thursday approved a $500 million school choice bill mostly along party lines after hours of passionate debate. It will n...

.png)