Treasuries are mixed after seeing some pressure yesterday as the Federal Reserve expectedly announced that it will speed up the tapering of its monthly asset purchases. The yield on the 2-year note is declining 6 basis points to 0.61%, and the yield on the 10-year note is decreasing 3 bps to 1.43%, while the 30-year bond rate is ticking 1 basis point higher to 1.87%.

Many stocks are up today as well. Why? First of all, the market loves certainty. Knowing what to expect on the macroeconomic level next year goes a long way for investors that are closely watching their portfolios, as well as an assurance from the Fed that it is taking inflation seriously. Powell also balanced his rates outlook with a strong dose of optimism about demand and income, and confirmed that "we're making rapid progress toward maximum employment."

Weekly initial jobless claims came in at a level of 206,000 for the week ended December 11, versus the Bloomberg consensus estimate of 200,000 and compared to the prior week's upwardly-revised 188,000 level, which was the lowest in 52 years. The four-week moving average fell by 16,000 to 203,750, and continuing claims for the week ended December 4 dropped by 154,000 to 1,845,000, south of estimates of 1,943,000. The four-week moving average of continuing claims fell by 66,000 to 1,963,250.

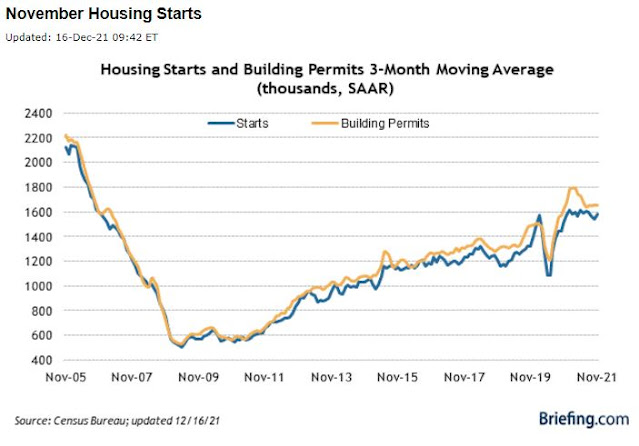

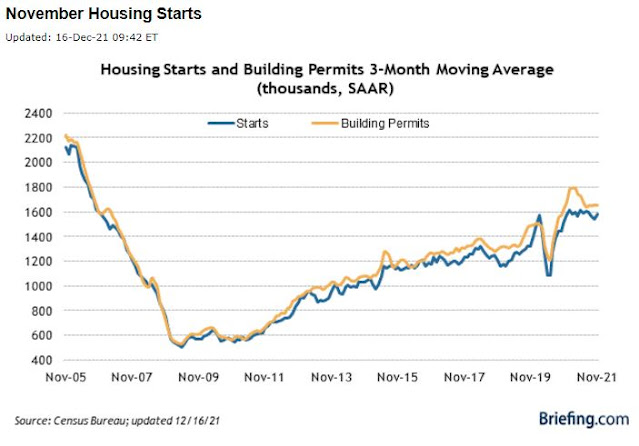

Housing starts for November rose 11.8% month-over-month (m/m) to an annual pace of 1,679,000 units, above forecasts of 1,567,000 units, and compared to October's downwardly-revised pace of 1,502,000 units. Also, building permits, one of the leading indicators tracked by the Conference Board as it is a gauge of future construction, advanced 3.6% m/m at an annual rate of 1,712,000, north of expectations calling for 1,661,000 units, and compared to the upwardly-revised 1,653,000 unit pace in October.

Weekly initial jobless claims came in at a level of 206,000 for the week ended December 11, versus the Bloomberg consensus estimate of 200,000 and compared to the prior week's upwardly-revised 188,000 level, which was the lowest in 52 years. The four-week moving average fell by 16,000 to 203,750, and continuing claims for the week ended December 4 dropped by 154,000 to 1,845,000, south of estimates of 1,943,000. The four-week moving average of continuing claims fell by 66,000 to 1,963,250.

Housing starts for November rose 11.8% month-over-month (m/m) to an annual pace of 1,679,000 units, above forecasts of 1,567,000 units, and compared to October's downwardly-revised pace of 1,502,000 units. Also, building permits, one of the leading indicators tracked by the Conference Board as it is a gauge of future construction, advanced 3.6% m/m at an annual rate of 1,712,000, north of expectations calling for 1,661,000 units, and compared to the upwardly-revised 1,653,000 unit pace in October.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.