By Gary Halbert

U.S. home prices soared by 18.4% in October alone over year-ago levels. That was actually slightly below the annual increase of 19.1% in September. Home prices are on fire, and no one knows how this unprecedented bull market will end.

Here you can see what US home prices have done over the last 50+ years. The price rise has been spectacular, with no end in sight. Since the last low in 2010, median home prices have more than doubled from near $200,000 to above $400,000 today.

Here you can see what US home prices have done over the last 50+ years. The price rise has been spectacular, with no end in sight. Since the last low in 2010, median home prices have more than doubled from near $200,000 to above $400,000 today.

The median home sale price in the US was $404,700 at the end of the 3Q. It is considerably higher in certain popular zip codes. Those would include Phoenix, Tampa and Miami just to name a few. Minneapolis and Chicago posted the smallest increases over the past year but still increased by 11.5%.

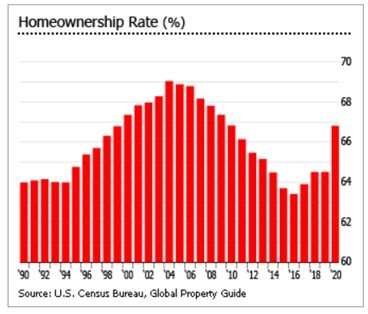

The housing market has been strong thanks to rock-bottom mortgage rates, a limited supply of homes on the market and pent-up demand from consumers locked in last year by the pandemic. Many Americans, tired of being cooped up at home during the pandemic, are looking to trade up from apartments to homes or to bigger houses.

The great housing boom in the US continues unabated after eight years of strong house price growth. It has been buoyed not only by continued low interest rates but also by the government’s massive stimulus packages to cushion the impact of the pandemic. A limited supply of properties on the market has added to upward house price pressure.

House prices continue to rise strongly in all of the country’s 20 major cities, according to Standard and Poor’s, with Phoenix posting the highest increase of 32.41% year-over-year in July 2021, followed by San Diego (27.79%), Seattle (25.5%), Tampa (24.41%), Dallas (23.66%), Las Vegas (22.45%), Miami (22.23%), San Francisco (21.98%), Denver (21.31%) and Charlotte (20.89%).

Strong house price rises were also seen in Portland (19.54%), Los Angeles (19.12%), Boston (18.73%), Atlanta (18.48%), New York (17.86%), Cleveland (16.23%), Detroit (16.12%), Washington (15.84%), Minneapolis (14.56%) and Chicago (13.32%).

“On the supply side, it is also the result of chronic under building, especially of affordable stock. This lack of supply is unlikely to be resolved over the next 5 to 10 years without more aggressive incentives for builders to add new units.”

Will US homebuilders be able to keep up with demand? Probably not say most industry experts. US homebuilder sentiment stood at 76 in September 2021, up slightly from 75 in the previous month, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

A reading of 50 is the midpoint between positive and negative. Sentiment stood at 83 in September 2020 and reached a record high of 90 in November. It then dropped dramatically in the following months, as lumber prices surged and supply chain disruptions hampered construction activity.

The question is, can this unprecedented housing market boom continue at this rate? The answer is probably not. That doesn’t mean it can’t go any higher before it slows down, but runaway bull markets like this don’t tend to end well. That remains to be seen, of course.

The last housing crash began in 2Q 2006. There was a 33.3% fall in the S&P/Case-Shiller composite-20 city home price index from 2Q 2006 to 4Q 2011. Phoenix registered the biggest drop (-54.7%) among the 20 largest metro areas, followed by Miami (-50.5%), Detroit (-43.3%), San Francisco (-40.8%), Los Angeles (-40.1%), and San Diego (-39.7%).

The US housing market started to recover in the second half of 2012. In 2013, the S&P/Case-Shiller composite-20 home price index soared 13.5%, then rose by 4.4% in 2014, 5.5% in 2015, 5.4% in 2016, 6.2% in 2017, 4% in 2018 and by 2.8% in 2019.

And despite the pandemic, the US housing market surprisingly continued its strong growth, with the S&P/Case-Shiller composite-20 home price index rising by a huge 22.7% in Jan 2020-Jul 2021. Phoenix led the boom, with house prices surging by 38.6% over the period.

The question of how long this boom in the US housing market will last is impossible to answer. A great deal depends on the health of the US economy. Right now, that looks pretty good. We just have to keep a close eye on things as we always do. I’ll keep you posted.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.