Update, Jun 11: As I noted below, a danger in stop orders is that if the prices gaps below your indicated sell price, the order will be executed lower than you anticipated. This was the case today for SCHD, the example used below. The stop price was $54.45. However, the market gapped down at opening, and SCHD sold at 53.63. (See chart below). I still kept a profit of $840, but this was slightly lower than I had planned. But if the market continues to sell off, I will have protected at least most of my profit in the position. I have the option of buying back in, if I think the market will reverse.

One method to manage this situation is through the use of sell stop orders. A sell stop order tells your broker to sell shares if the price meets or exceeds the price you set. Let's look at an example.

AMD is currently at $33 a share. You don't know which way it will go, and you have a $12 per share profit. You could sell, but you could also place a sell stop order. So you place a stop order at $31 a share. If the prices hits $31 or lower, your broker will sell your shares (or how many you specified; you don't have to sell your entire position). If the price goes up, which it did, nothing happens. And you could cancel your stop loss order and enter a new one at a higher price. Some brokers will allow you to place a trailing stop. In other words, you could specify $2 per share, or a percentage.

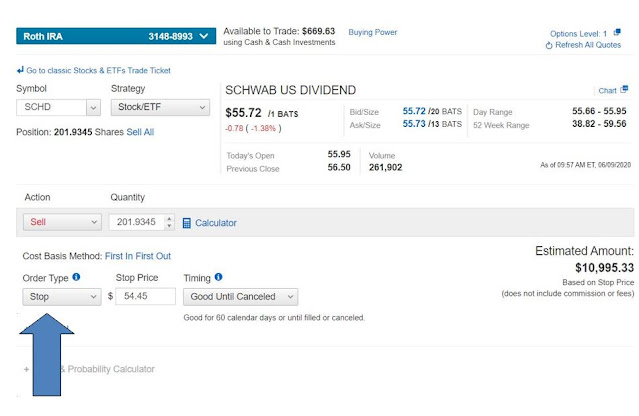

Let's look at a real-world example. I own 200 shares of SCHD, which is the Schwab U.S. Dividend Equity ETF, which holds Exxon, Home Depot, Intel, Bristol Myers, Texas Instruments and 92 other stocks.

Today, June 9, SCHD closed at $55.77. I originally purchased it for $49.77, so I have a small profit of $1,200, which I'd like to protect. I could sell, but the if the market continues up, I would lose out on these gains. So I put in a sell stop order with my broker to sell at $54.45, when the price was $55.72. I placed my stop about 3.5% below the current price. You can use any type of formula you'd like. A popular one is to place the stop 1 or 2 percent below the 50-day moving average, but I like to be a bit tighter. If I get stopped out, I can always buy in again. Not the best way to manage positions, as it contributes to higher taxes because of possible short-term gains, but I'd rather pay a bit more in taxes than allow a winning position turn into a losing position.

The illustration below shows my order screen. Note that I only had to change the order type from Market to Stop and enter the price of my stop.

Note: There is a danger with stops. If the prices gaps down, say to $54, your stop will be executed at the lower price. So be aware of this. You can place a Sell Order called a Stop-Limit. You can read a full explanation of the difference between Stop and Stop-Limited orders at Investopedia.com. I recommend you do. You should educate yourself and feel comfortable with these types of orders.

Happy Investing.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.