A normal supply and demand curve indicates that as prices increase, demand will moderate or decline, until the curve reaches a new equilibrium. That is what is happening this year in housing.

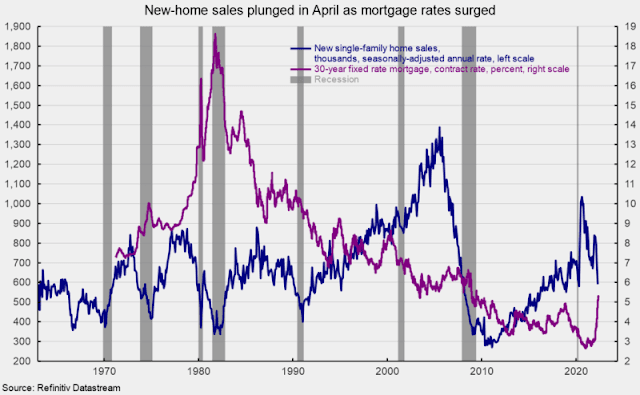

Sales of new single-family homes plunged in April, declining 16.6 percent to 591,000 at a seasonally-adjusted annual rate from a 709,000 pace in March and just slightly ahead of the 582,000 pace at the bottom of the lockdown recession.The April drop follows a 10.5 percent decline in March, a 4.7 percent fall in February, and a 1.0 percent drop in January. The four-month run of decreases leaves sales down 26.9 percent from the year-ago level (see chart). Meanwhile, 30-year fixed rate mortgages were 5.3 percent in late May, up sharply from a low of 2.65 percent in January 2021.

The median sales price of a new single-family home was $450,600, up from $435,000 in April (not seasonally adjusted). The gain from a year ago is 19.6 percent versus a 21.0 percent 12-month gain in April. On a 12-month average basis, the median single-family home price is still at a record high.

The total inventory of new single-family homes for sale jumped 8.3 percent to 444,000 in April, putting the months’ supply (inventory times 12 divided by the annual selling rate) at 9.0, up 30.4 percent from April and 91.5 percent above the year-ago level.

The months’ supply is at a very high level by historical comparison and is approaching peaks associated with prior recessions. The plunge in sales, high months’ supply, and surge in mortgage rates should weigh on median home prices in coming months and quarters. However, the median time on the market for a new home remained very low in April, coming in at 2.8 months versus 3.9 in March.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.